Does Annual Debt Service Increase Every Year

What is Debt Service?

Debt service refers to the total cash required by a visitor or individual to pay back all debt obligations. To service debt, the involvement and primary on loans and bonds must be paid on fourth dimension. Businesses may demand to repay bonds, term loans, or working capital loans.

In some cases, lenders may require companies to concur a debt service reserve account (DSRA) . The DSRA can act as a safety measure for lenders to ensure that the visitor's future payments will exist met. Individuals may need to service debts such as mortgage, credit carte debt, or student loans. The ability to service debt for both companies and individuals will impact their options to receive boosted debt in the time to come.

Summary

- Debt service refers to the cash required to pay back interest and principal on debt obligations. A company may be required to hold a debt service reserve account (DSRA) to reassure lenders.

- Debt servicing is of import in maintaining a good credit score for hereafter borrowing.

- The debt service coverage ratio (DSCR) is a mensurate of a visitor'southward ability to make debt payments on time.

Importance of Debt Servicing

Funding is critical for whatever business venture. A pop manner to acquire such funding is through borrowing money, merely obtaining debt is non e'er an easy task. The lender – whether it be a bank, lending institution, or investor – must have faith that the borrower will exist able to repay the loan earlier extending i. Hence, debt servicing capacity is a key indicator of the trustworthiness of a visitor.

A company that consistently services its debts will have a good credit score , which volition boost its reputation for other lenders. It will exist important for future ventures that crave boosted funding. Therefore, a finance manager should ensure a visitor maintains its debt servicing capability.

Individuals must too focus on debt servicing past managing their personal finances. By consistently servicing their debts, they tin also build a practiced credit score. Ultimately, a expert credit score volition meliorate their chances of getting a mortgage or car loan, or increasing a credit carte du jour limit.

How is Debt Service Calculated?

Debt service is determined past computing the periodic interest and principal payments due on a loan. Doing and then requires knowledge of the loan's interest charge per unit and repayment schedule. Calculating debt service is important to determine the cash menstruum required to cover payments. Hence, it is useful to summate annual debt service, which can then exist compared against a visitor'southward annual net operating income.

Practical Examples

For example, a company sells a bail with a face value of $500,000 at an interest rate of five%. Suppose the visitor agreed to pay interest at the end of every year, and at the end of vii years, information technology volition pay back the face value of the bond. In such a instance, the annual debt service for the kickoff year volition exist:

$500,000 x 0.05 = $25,000

At the end of the seventh year, the annual debt service will equal:

($500,000 ten 0.05) + $500,000 = $525,000

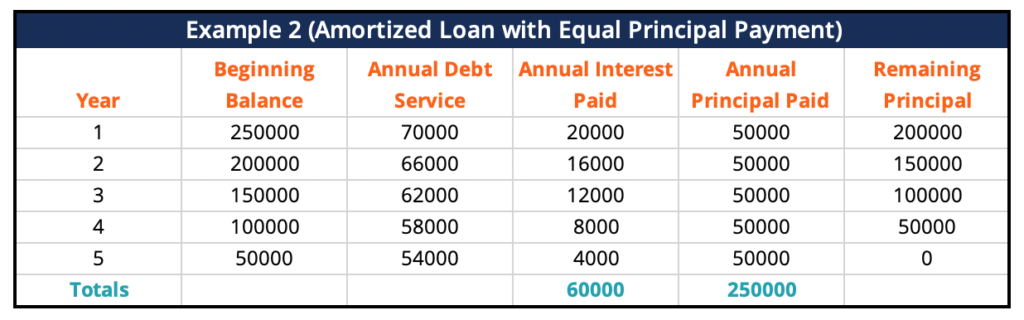

In a second example, a company takes on a $250,000 loan at an involvement rate of 8% for a term of five years. Suppose it is an amortized loan with equal principal payments. It means that the company will repay an equal amount of principal each period, plus 8% interest on the outstanding primary.

At the cease of the five-year period, information technology volition have repaid all the principal in addition to the interest. If the terms of payment were i installment a yr, the first yr'south debt servicing amount would be $70,000. The 2d year's debt servicing amount would exist $66,000, then $62,000, $58,000, and finally $54,000 in the final year.

Debt Service Coverage Ratio (DSCR)

A concern needs to compute its debt service coverage ratio (DSCR) earlier it begins borrowing. The DSCR is critical to measuring the company's ability to make debt payments on time. The ratio divides the company'due south cyberspace income with the total corporeality of involvement and primary it must pay. The higher the ratio, the easier for the company to obtain a loan.

The formula for calculating the DSCR is as follows:

DSCR = Almanac Net Operating Income / Annual Debt Payments

More Resources

CFI is the official provider of the global Commercial Banking & Credit Annotator (CBCA)™ certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional resources below volition be useful:

- Amortized Loan

- Creditworthiness

- Debt Schedule

- How to Calculate the Debt Service Coverage Ratio

Source: https://corporatefinanceinstitute.com/resources/knowledge/credit/debt-service/

Posted by: cookgrencir1939.blogspot.com

0 Response to "Does Annual Debt Service Increase Every Year"

Post a Comment